Build the future of banking by embracing disruption, innovation, and exceptional customer service. As the financial landscape evolves, Lera empowers banks to adapt seamlessly with AI-driven insights, domain expertise, and strategic partnerships. Combining core banking solutions with advanced AI-enhanced capabilities like AI, ML, & GenAI, we are poised to redefine banking to meet changing market trends and customer needs, driving excellence beyond expectations.

Partnering with Lera ensures game-changing solutions for banks. Our high-performance data solution processes millions of records in seconds, helping banks cut costs, stay innovative and optimize resources. From training, to timely reports to enhanced COB processes and seamless operations, we deliver results.

Our expertise spans L3 customization, banking software upgrades and dedicated support services, empowering banks to improve efficiency, drive innovation, and make smarter decisions for the future.

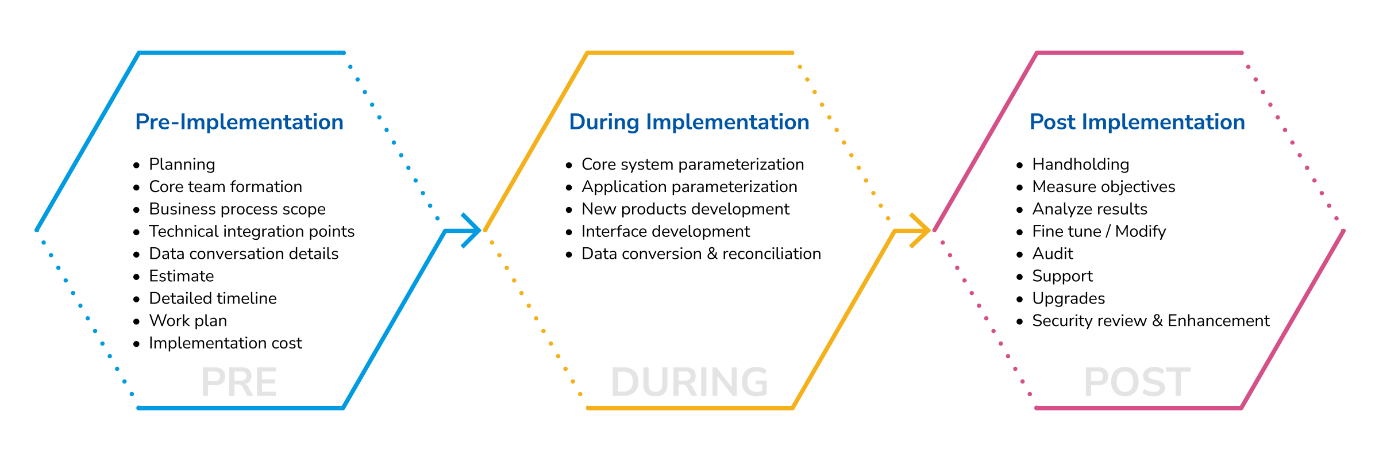

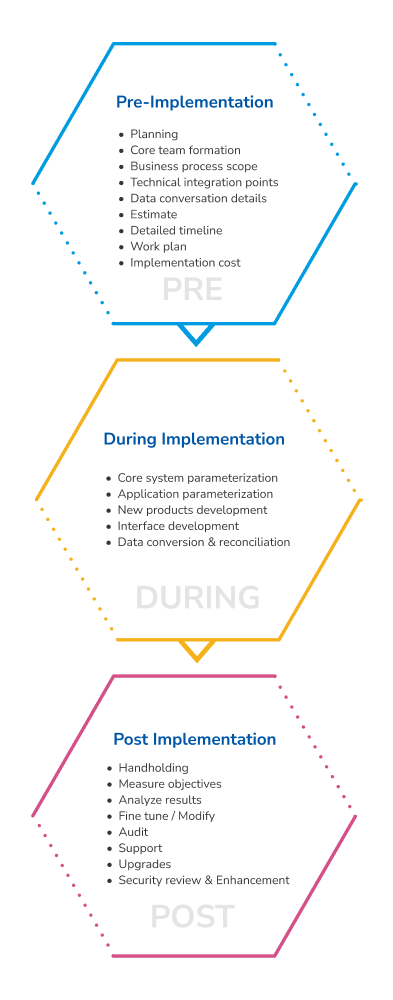

We partner with banks to implement new systems, transition from legacy platforms, and customization services to meet unique business needs. Our flagship data platform accelerates extraction, transformation, and loading processes, enabling banks to drive innovation, improve efficiency, and stay competitive.

9X Data Platform is a powerful ETL and Data Warehousing suite designed to optimize data processing, integration, and reporting for banks. By enabling seamless data flow across systems, it enhances decision-making, strengthens regulatory compliance, and boosts operational agility for future-agnostic banking.

We enhance banking systems with tailored solutions that improve security and accelerate updates. Leveraging microservices enable faster integrations and seamless changes, ensuring stability and minimal downtime. Our L3 customization services further refine system capabilities for improved performance and customer experience.

Lera’s engagement models—Time & Materials, Factory, and Fixed Price—help banks and financial institutions achieve cost efficiency, compliance, and digital transformation with agility and transparency. By leveraging Strategic Outsourcing, Staff Augmentation, and Structured Workflows, we ensure seamless operations, optimized resources, and faster execution.

From requirement gathering to deployment, our approach fosters scalability, risk mitigation, and growth. Whether it’s on-demand expertise, predictable costs, or adaptable execution, our models empower businesses to navigate complexities with confidence.

Partner with Lera for Future-Ready Banking Solutions.